What is it like to be the victim of a pension scam?

Most of us are at risk of being the victim of a pension scam.

The pension freedoms, introduced in 2015, give people more choice in how they use their pension savings.

People can now access a wider range of investments. As a result, people are also at risk of a wider range of scams and financial fraud.

We want to know how pension savers are protected and what more can be done to support them. We have focused on pension scams first.

Many victims of pension scams got in touch with us during our inquiry. This is what they told us.

"Intense mental anguish"

- G M Say, pension scam victim

Pension scams cause lifelong financial harm to their victims. They can also have a lifelong impact on their mental wellbeing.

G M Say wrote to us about their experience of being scammed, describing a feeling we heard from many others:

"Aside from the huge sense of loss and financial devastation, there is also the intense mental anguish which victims suffer for many years into the future"

"No support

was available"

- Sue Flood, pension scam victim

Many victims of pension scams never report that they have been scammed. Others only report a scam a long time after it happened.

But when scam victims do make a report, it is reasonable to expect that there will be action. They understandably feel let down when there is not. A 2019 investigation by the Times found serious failings at Action Fraud, the UK’s national reporting centre for fraud and cybercrime.

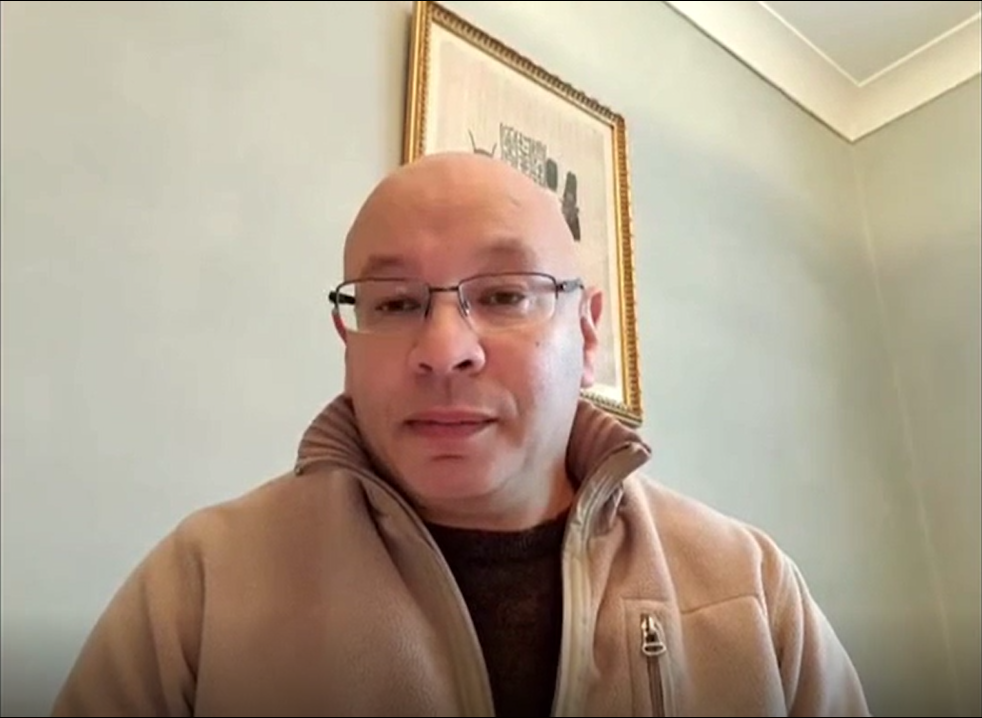

On 2 December 2020, pension scam victim Sue Flood told us about her experience of Action Fraud.

Regulators seem

powerless to hold

online firms to account

We heard a lot about the impact of pension scammers moving online, including how they:

- Advertise themselves online

- Contact potential victims through social media

- Impersonate real businesses or claim a fake relationship to one.

Regulators seem powerless to hold online firms to account for hosting scam adverts in the same way they would for traditional media like TV or newspapers.

We also heard that tech firms like Google are being paid to advertise scams while also being paid by regulators to warn about scams.

Guy Opperman MP, the Minister for Pensions and Financial Inclusion, made his thoughts on this situation clear to us.

"Scamming is a Low Risk, High Reward business"

Several different organisations are responsible for regulating pension scams. The fact that reporting, investigating and prosecuting is dealt with by different bodies has made tackling pension scams harder.

Mr Stephen Sefton, a pension scam victim, wrote to us to say:

"Scamming is a Low Risk, High Reward business for the perpetrators. Very, very few perpetrators get prosecuted, regardless of the fraudulent misrepresentations they employ to con people from all walks of life and educational ability."

The Financial Conduct Authority told us that "there have been a very large number of prosecutions involving scams and unauthorised business".

But we do not agree. Its own figures, which are only available because of Freedom of Information requests, show that there were just 25 convictions between 2012 and 2020.

"I have been pursued quite relentlessly by HMRC"

- Dennis Waite, pension scam victim

As well as ruining someone’s financial future, a pension scam can leave them with large unexpected tax bills.

Pension liberation scams often involve scammers claiming that there are legal loopholes, like loans or cash incentives, which can allow a person to access their pension early without the victim having to pay tax. This is not true.

As a result, HMRC will pursue these charges. It is legally correct for them to do so, but their approach lacks empathy or understanding of the impact these demands have on victims.

On 2 December 2020, pension scam victim Dennis Waite told us about his experience with HMRC.

What should the

Government do?

More than five years on from the introduction of the pension freedoms, the Government and regulators are still putting in place the necessary support framework to tackle scams.

We call on them to act quickly and decisively to protect pension savers in the following ways:

1.Pension scam victims may need to contact several different organisations. This can be complicated and they should not have to do it on their own. Action Fraud should arrange appointments for pension scam victims with organisations which may be able to help them.

2.Paid-for adverts on online platforms should be covered by the same rules as adverts on traditional media, like television or newspapers. The Online Safety Bill, which the Government says it will publish soon, should include laws against online investment fraud.

3.HM Treasury should recognise that, in some situations—where the saver has been the victim of a crime and made no financial gain from accessing their pension early—it may not be in the public interest to demand payment of tax due.

4.An existing project to tackle pension schemes is welcome, but it is not enough. There should be a new Pension Scams Centre with dedicated funding and staff, to manage a pension scams intelligence database alongside the police.

5.The DWP should create a strategy to make sure that all pension scam victims are offered and encouraged to take support for both the financial harm and mental distress caused by pension scams.

Where to get help

We can't take any action on individual cases. But we hope that our recommendations will help past victims and prevent future scams.

If you have any concerns about an offer you’ve received, or about a conversation you’ve had about transferring or accessing your pension, you can check with The Pensions Advisory Service.

They can also give you advice if you’ve been a victim of a scam.

You can speak to a pension specialist at The Pensions Advisory Service on their helpline on 0800 011 3797 (Monday to Friday from 9am to 5pm) or use their webchat service or online enquiry form.

If you’ve been a victim of a scam and need support

You can contact Victim Support or Think Jessica if a scam has made you feel anxious, fearful or guilty. They provide emotional and practical help to victims of crimes and scams.

You can contact the 24-hour Samaritans helpline on 116 123 if you feel low or anxious and need someone to talk to.

You can contact Citizens Advice if you’re having trouble paying your bills and are worried about what to do.

What happens next?

The Government must now respond to our report

Our report, Protecting pension savers—five years on from the pension

freedoms: Pension scams was published on 28 March 2021.

If you’re interested in our work, you can find out more on the House of Commons Work and Pensions Committee website. You can also follow our work on Twitter.

The Work and Pensions Committee looks into the policies and spending of the Department for Work and Pensions, including benefits for people in and out of work, state pensions and how private pensions are regulated. It also scrutinises DWP’s public bodies and other regulators.

Cover image credit: DWPDigital, Open Government Licence v3.0